From cancer to autoimmunity: The next frontier for immunotherapy

Recent advances in immuno-oncology, especially CAR-T cell therapies, have inspired a shift in drug development towards treating autoimmune diseases, as demonstrated by successful trials in conditions like systemic lupus erythematosus. We are now seeing a significant increase in autoimmunity projects, leveraging shared immune pathways and repurposing existing cancer therapies to accelerate discovery and reduce development time.

|

October 13, 2025

|

6 min read

In recent years, the drug discovery and development industry has experienced a movement in research focus, with many using immuno-oncology (I-O) findings to support autoimmunity research.

In 2022, a ground-breaking Nature Medicine study reported that the chimeric antigen receptor T cell (CAR-T) treatment, originally developed for haematological cancer treatments, had treated five cases of the chronic autoimmune condition, systemic lupus erythematosus (SLE), leading to remission. This study sparked a wave of follow-up trials and a new research niche of cell-based and engineered immune therapies for autoimmune diseases.

At RoukenBio, we have seen this shift first-hand. Between 2023 and 2025, our customer projects for immuno-oncology drug discovery and translational research dropped from 98% to 47%, while autoimmunity projects have increased from 0% to 37%.

In this article, Dr Gavin Meehan, the Associate Scientific Director of Immunology at RoukenBio, explores the challenges and benefits of this trend, the impact on the industry and patients, and whether it’ll continue in the future.

Why is this trend occurring?

The ‘gold rush’ of immuno-oncology was sparked by landmark breakthroughs in the early 2010s, notably, the emergence of immune checkpoint inhibitors that delivered durable remissions in previously untreatable cancers, and the remarkable success of CAR-T cell therapies in haematological malignancies. These advances triggered a surge in investment for further I-O research and accelerated review processes to approve promising cancer treatments as quickly as possible.

While I-O had delivered transformational therapies, the market has become oversaturated with many companies targeting the same immune pathways and indications. This overcrowding has increased competition for funding, reduced patient recruitment for clinical trials, and ultimately made it more difficult to bring new drugs to market.

Despite sharing many of the same immune pathways, autoimmunity has until recently remained a relatively untapped market for immunotherapies. However, with over 100 distinct conditions and a rising global prevalence, this is beginning to shift. A 2023 population-based study published in The Lancet estimated that the incidence of autoimmune disease is around 1 in 10, showing the need for treatment options.

Therapeutic developers are increasingly recognising the value of diversifying beyond I-O, drawn by the multi-indication potential, chronic treatment models, and a less saturated competitive landscape, making autoimmunity an emerging and attractive area for investment.

Repurposing existing molecules developed for I-O is a particularly fruitful area, as it allows companies to apply existing drugs to a different disease context with reduced development time and fewer regulatory hurdles. This process offers drug manufacturers the opportunity to maximise the return of their R&D investment into an asset by expanding the revenue-generating potential.

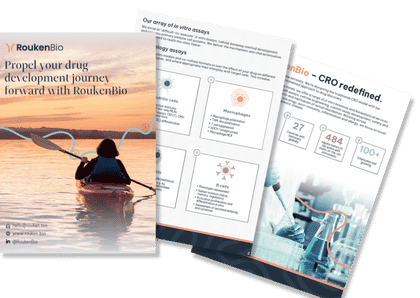

In terms of drug development, the shared immune pathways and mechanisms between cancer and autoimmunity offer the opportunity to re-purpose I-O in vitro assays, albeit with a reserved readout. At RoukenBio, we initially adopted this approach in response to growing demand for autoimmune-focused therapeutics.

This was subsequently followed by the development of assays tailored to autoimmune mechanisms of action, including the creation of engineered and reporter cell lines, more complex co-culture systems, and the incorporation of a broader range of immune cell types than previously utilised.

What are the benefits?

In addition to I-O cell therapy being less competitive for treating autoimmune diseases, there are many other benefits to consider; for those conducting the research, the patients receiving treatment, and the industry as a whole.

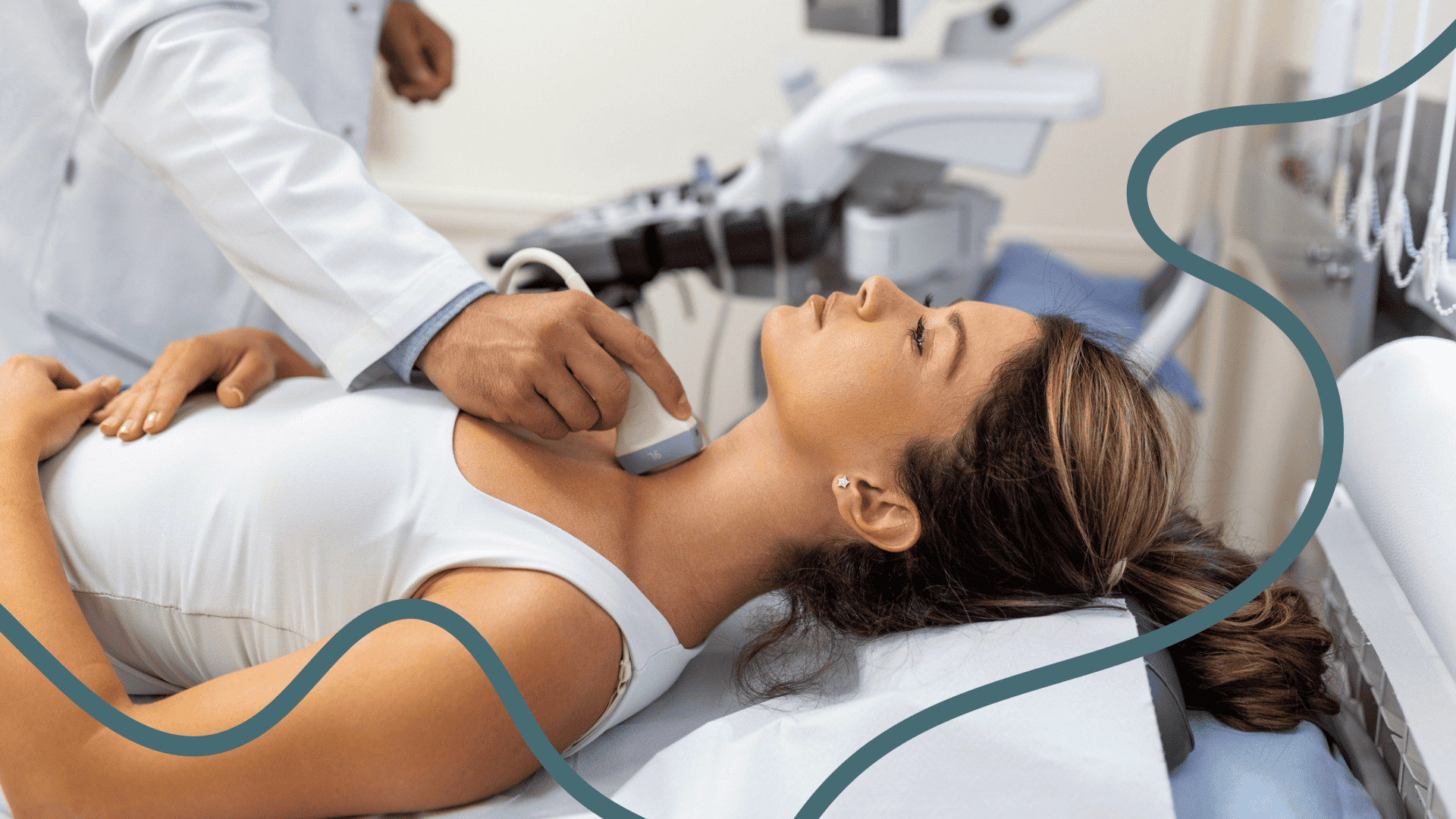

Improved quality of life for patients

This research is making waves because it has the potential to provide new options to patients who may have been unresponsive to conventional treatments or relied on drugs with heavy side effects, e.g. steroids. These breakthroughs can be life-changing for patients.

A 2024 study described a CAR-T therapy to treat SLE, idiopathic inflammatory myositis (IIM) or systemic sclerosis among 15 patients. A median follow-up of 15 months found that all patients were ultimately able to stop immunosuppressive treatment. Similar therapies were found to be effective in inducing disease remission or sustained symptom control in stiff person syndrome (SPS), myasthenia gravis (MG) and ankylosing spondylitis (AS).

Saving time and resources

Many lessons have been learned from the development of immunotherapies in oncology, including a detailed understanding of different modalities (e.g., CAR-Ts, antibodies and bispecific engagers), the suitability of particular assays for screening drugs or understanding mechanisms of action, and the format of clinical trials. Applying these findings to autoimmune research can help reduce the early discovery phase, allowing therapies to come to market at an increased pace.

The strategy of repurposing existing molecules from I-O to autoimmunity can bypass much of this early discovery work, as the I-O therapy targets will likely have already undergone preclinical safety studies, and some phase I safety testing in humans may also have taken place. Having this information reduces the chance of early failure compared to completely new and untested approaches.

We are already beginning to see this occur with B-cell-modifying and B-cell-depleting therapies, originally developed for I-O, that are now being repurposed to the autoimmunity market. Early evidence suggests that these therapies are highly effective in controlling antibody-driven autoimmune diseases, which should lead to improved outcomes for many patients.

The commercial opportunity

As autoimmune diseases often require lifelong management, there is a huge demand for research discoveries. While the current market is already large, it’s crowded with medications that target the same pathways, whereas advanced cell therapies are still relatively unexplored in the space. With entry therapies, companies can stand out against competitors and establish a reputation as market leaders.

Additionally, funding opportunities for autoimmunity are growing, buoyed by the success of previous trials demonstrating the efficacy of cell-based therapies in these indications. As this research builds upon expertise generated from I-O, it can require a smaller upfront investment.

What are the challenges of this trend?

While this research trend can bring many advantages, there are still various challenges and risks companies should consider to maximise success.

I-O research might not always apply

Although cancer and autoimmunity share many immunological pathways, they both represent two fundamentally opposed states. In cancer, the immune system fails to recognise or effectively attack malignant cells due to immune evasion mechanisms and immune cell dysfunction. In contrast, autoimmune diseases arise from excessive or misdirected immune activation, where the immune system mistakenly targets healthy tissues.

However, certain therapies can apply to both disease models. For example, B-cell depletion therapies would be beneficial in both haematological malignancies and antibody-associated autoimmune diseases, including SLE. However, in most circumstances, I-O therapeutics, such as conventional checkpoint inhibitors, would not be suitable for treating autoimmune diseases as they would enhance immune cell activity. Finding common mechanisms that can be manipulated to increase or decrease immune activation is a potential method that would allow for the identification of drugs at either end of the spectrum.

Approval barriers

Approval barriers for immunotherapies in autoimmunity are shaped by a more cautious regulatory stance compared to oncology, largely due to differences in disease severity and treatment expectations.

As cancer patients often face life-threatening conditions, regulators and the patients themselves are more willing to accept therapies with significant risks if the potential benefit is high. In contrast, autoimmune diseases are typically chronic and manageable, so regulators demand a more favourable safety profile. Consequently, therapies like CAR-T cells, which carry risks such as cytokine release syndrome or long-term immune suppression, face stricter scrutiny in autoimmunity.

Regulators often require longer follow-up periods, more comprehensive immune monitoring, and robust evidence of durable disease control before granting approval. Regulatory agencies also expect tighter control over variability and more rigorous safety data, especially for therapies intended for long-term use.

Unlike oncology, where expedited pathways are more common, autoimmune therapies have fewer precedents for accelerated approval. As a result, developers must navigate a more demanding regulatory environment, balancing innovation with the need for precision, tolerability, and long-term safety.

Pharmaceutical companies may well choose to play it safe in the development of drugs, given these circumstances. However, innovation has repeatedly led to the development of improved treatments and will ultimately benefit patients in the long term. As more therapies are authorised for these indications, the approval process itself will also become clearer and more well-defined, making it easier to bring future therapeutics to the market.

Science and business incentives clash

While there is a huge opportunity for successful autoimmunity treatment, investors may be less likely to fund research that aims to reduce long-term care. Therapies designed to reset the immune system are expensive to develop and manufacture, and if successful, will condense the market over time and limit recurring revenue.

To counteract these conflicting goals, companies may charge a premium price for one-off treatments or design therapies that combine long-term results with some ongoing maintenance. Although this may be considered controversial, when factoring in the long-term medical costs and quality-of-life improvements offered by conventional treatments, these one-off therapies may represent good value for money for patients.

The future of this trend

At RoukenBio, we anticipate this trend will continue as it discovers revolutionary approaches to treating a significant portion of the population. However, there are still various considerations for the future of this research space.

Will herding occur in autoimmune research?

Although the application of cell therapies to autoimmune disease is fairly recent in comparison to other modalities, it’s still possible that herding will occur in the future, with too many companies focusing on the same end goal.

There is a risk of certain mechanisms of action becoming overused, i.e. B-cell depletion. However, with the diversity of the immune response, particularly in autoimmune disease, there is a large scope for companies to develop therapies focusing on different aspects of the immune response and a variety of immune cell players.

The long-term impact on patients

As this research is still relatively new, the lasting durability of these treatments is not yet determined and ongoing monitoring is needed. To maintain lifelong remission, treatment will need to be effective for decades. There is also the possibility of long-term side effects. However, initial results show promising signs of positive impacts for patients.

Despite these unknowns, autoimmune patients will benefit from the development of more effective, targeted therapies that should improve quality of life and have fewer side effects than conventional treatments. Ultimately, both I-O and autoimmunity patient groups will benefit from the lessons learned from the development of therapies in either area.

Will the trend change I-O research?

While more I-O researchers are shifting their focus to other indications, this change of direction is unlikely to replace cancer research. Cancer affects a disproportionate amount of the global population and is still a leading cause of mortality.

Undoubtedly, the funding of drug development in cancer, whether it be from charities, government or private enterprises, will continue, but that doesn’t mean there isn’t also space for the development of therapies in other diseases. This is particularly true when certain mechanisms or cell types are shared between diseases.

It is possible that this trend may slow cancer research due to resources being split and funding being more difficult to secure. However, it will hopefully contribute to less overcrowding in oncology, potentially allowing only the strongest approaches to stand out. In addition, knowledge sharing between the two fields is likely to accelerate innovation in both, especially as immune modulation becomes increasingly precise and personalised.

The early success of immuno-oncology cell treatment for autoimmune diseases is driving a vital shift in the industry, easing the overcrowding in oncology while opening new opportunities for much-needed breakthroughs in autoimmunity.

Join our community of curious minds on LinkedIn

🗓️ Stay informed with our monthly scientific newsletter, published on LinkedIn on the last Wednesday of each month.

These editions bring you the latest in drug development breakthroughs, industry trends, and expert insights from the brilliant minds at RoukenBio.

Subscribe today on LinkedInPartner with RoukenBio for Autoimmunity Drug Development

At RoukenBio, we specialise in a wide range of off-the-shelf and bespoke assays designed to explore the immune processes driving autoimmunity. Whether you're in early discovery or advanced development, our capabilities can support your next breakthrough.

See our assay capabilities